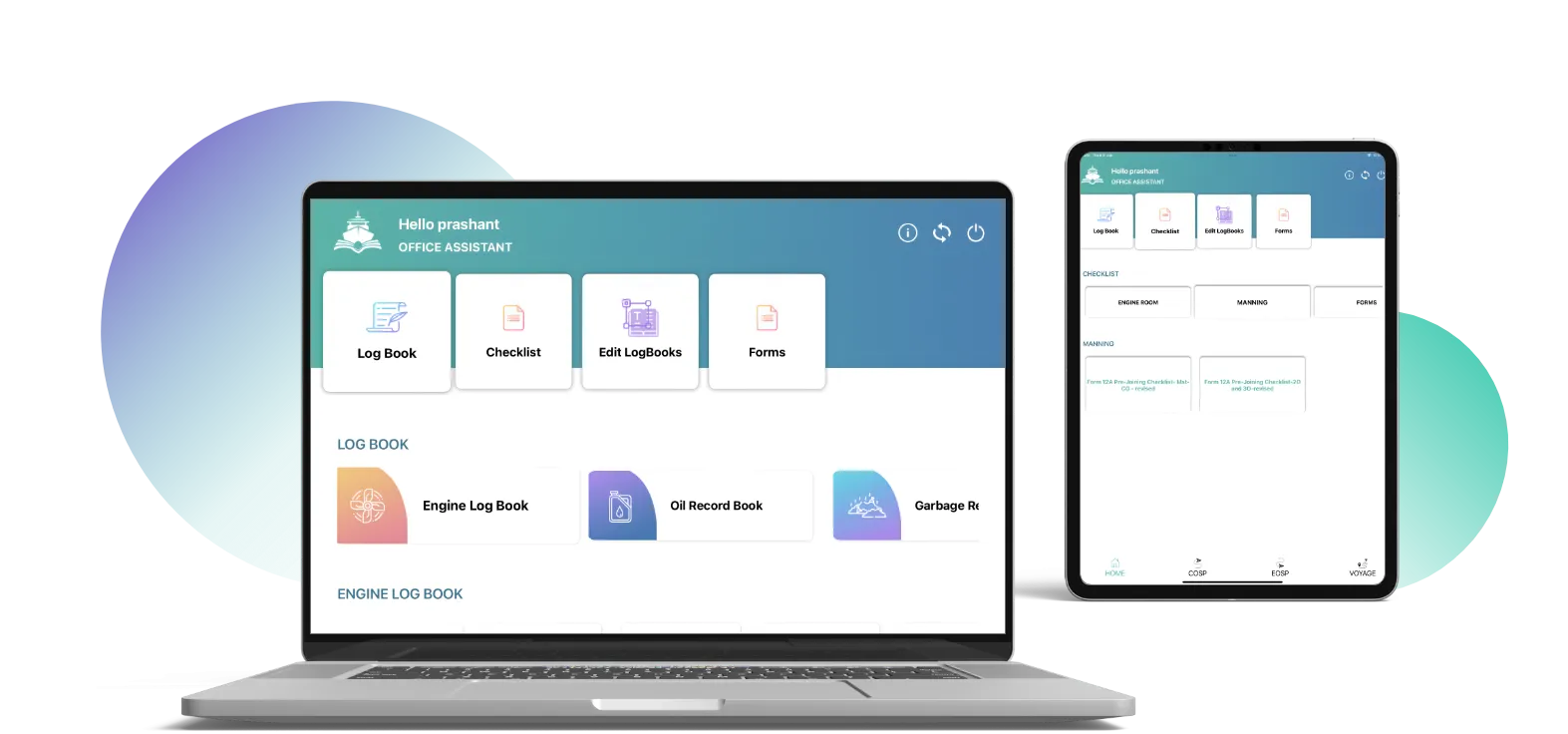

Equipped with the ability to support multiple device entry, iLogs provides utmost convenience by allowing users to easily input data from any location on the vessel. This feature enhances efficiency by updating data in real time.

About iLogs

For customer

service that never stops

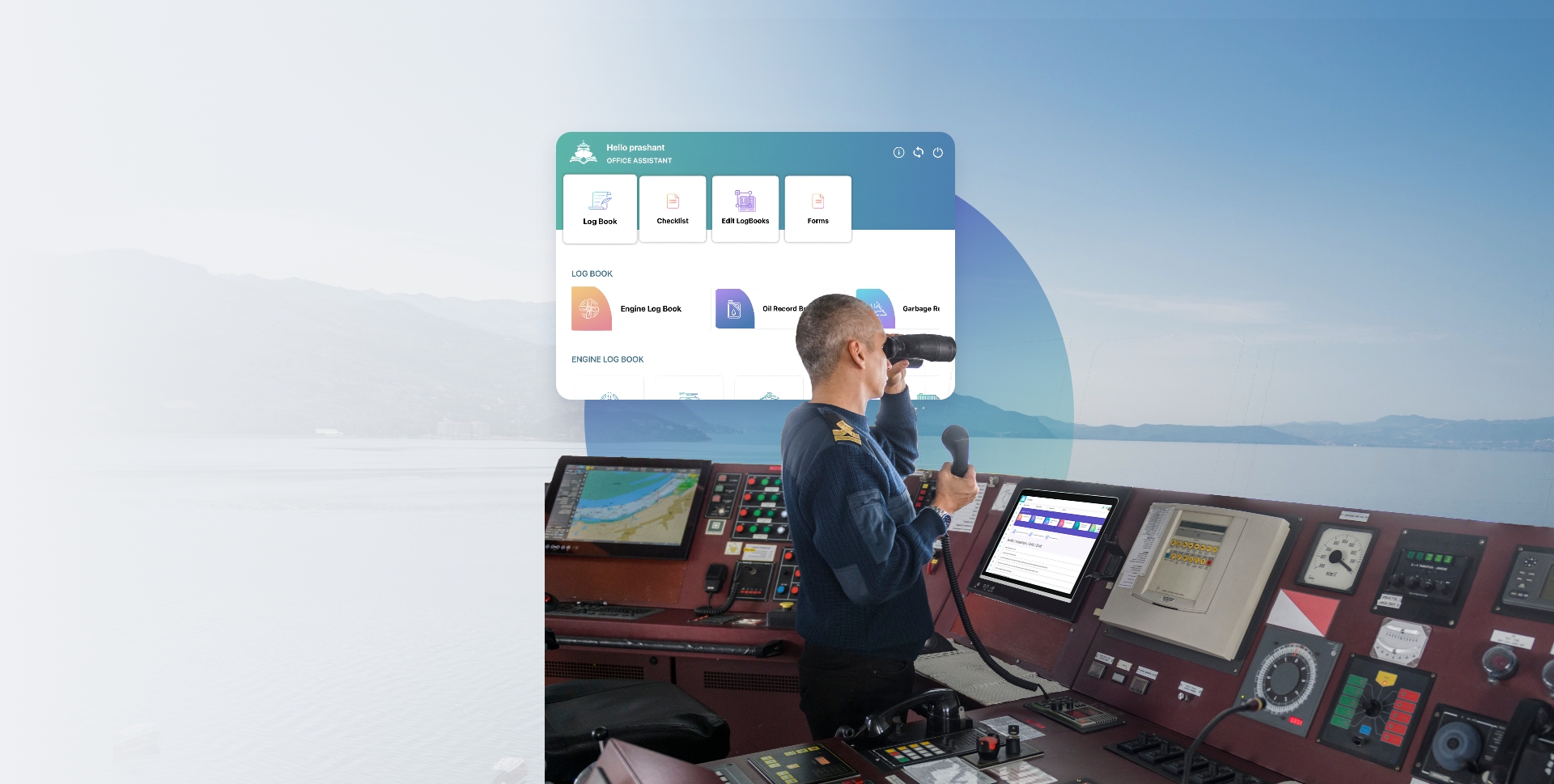

Intelligent Logs revolutionises data capture and analysis with its versatile application, accessible from any on-board computer or Android and iOS mobile devices. Seamlessly synchronise captured data to onshore servers, enabling comprehensive monitoring and in-depth analysis for optimised operations.

Innovation

Teamwork

Commitment

Excellence

Core Benefits

For customer

service that never stops

No more papers, no more waste & no more photocopying. Replace your traditional

paper logbooks with our “Intelligent logs”, the cost effective electronic solution.

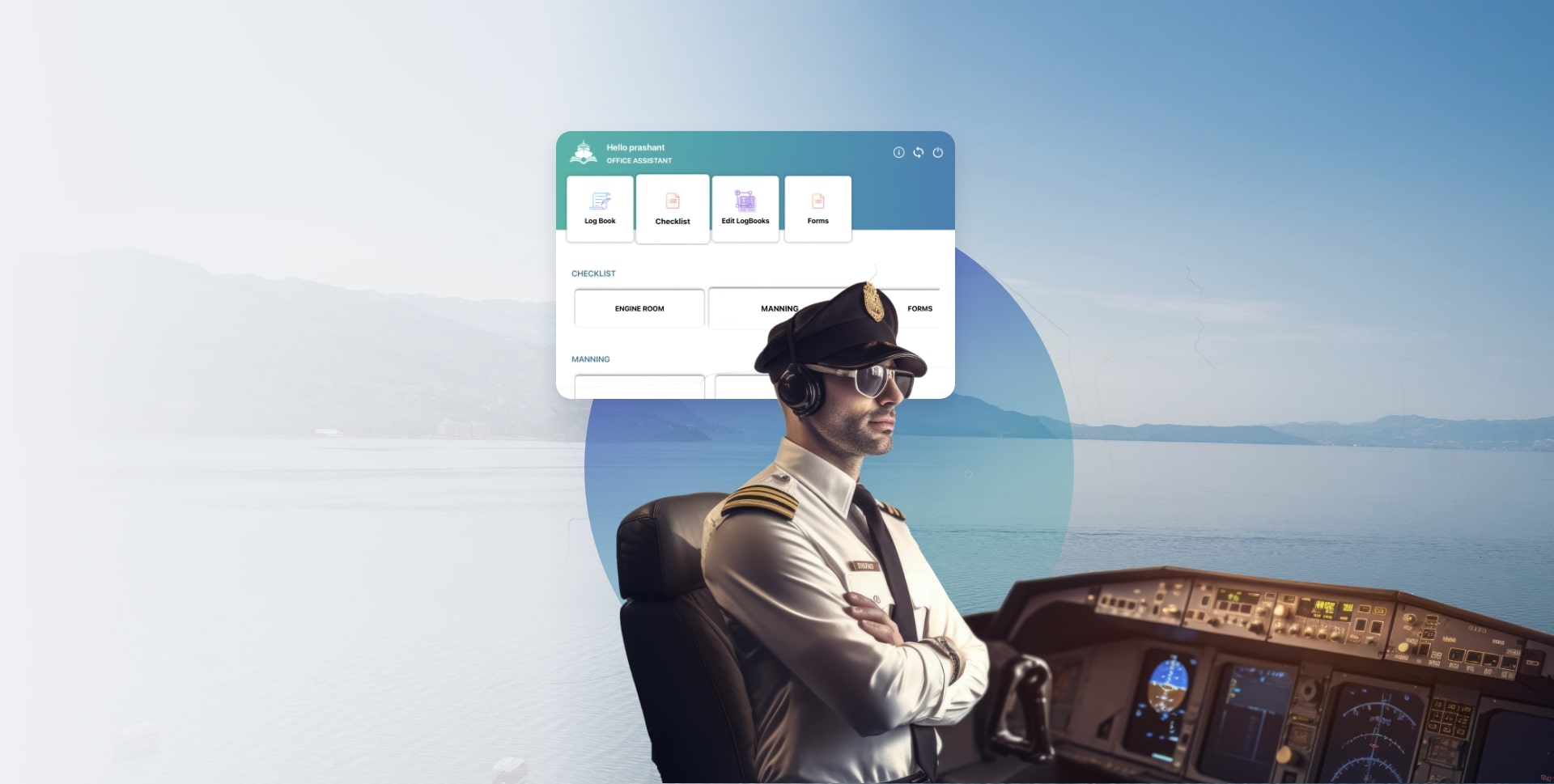

Multi Device Entry

Secure

iLogs boasts a highly robust and reliable security feature. This intricate security mechanism is controlled by a combination of a user name, a password, and a vessel-specific passcode.

Easy and Intuitive UI

The User Interface is crafted with an intuitive design that aims to provide a seamless experience for the crew. The users are guided through a well-considered flow that anticipates their needs and responses.

Robust Notification System

All key stakeholders are consistently updated with new data entries as they become available via our seamless notification system. This allows for prompt and informed decision-making and operational effectiveness.

Real Time Data Analysis

The system is designed to transfer data in a real-time manner when the vessel is in network range. The data is then sent directly to the dedicated shore team to convert this raw data into meaningful and actionable business intelligence.

Decrease workload and errors

Paper logs are replaced, saving both time and effort for the onboard team, while its data validation feature reduces error rates significantly.

Transparent

Additionally, logbook entries and alterations require authority sign offs. In addition to these features, the system maintains transparency through its ability to track any changes in data entry.

Dynamic

All our Forms and Checklists are dynamic. The user has the power to design, control, and manage all the fields and inputs. These products can be customised by the owner to cater to the specific needs of their team and organisation.

Features

Maximum productivity

with minimum use

Touch-screen/tablet compatible checklist viewer.

Easy-to-use dynamic solution that provides you with the freedom to create and monitor SOPs on board the vessel through checklists and forms.

Compliant and approved Log Book System from Bahamas & Marshall Island Flag States.

iLogs comes with an inbuilt Business Intelligence tool that allows you take informed decisions.

Secure and reliable system that allows for digital signoffs on completed logbooks.

Summary of the completed checklists is saved locally which can be printed and can be automatically shared with the shore office.